Our goal is to build a relationship with you based on trust, knowledge and mutual communication so you feel confident your needs are being met. We spend a lot of time upfront getting to know you and also making sure you understand how we work collaboratively on your wealth plan.

Our goal is to build a relationship with you based on trust, knowledge and mutual communication so you feel confident your needs are being met. We spend a lot of time upfront getting to know you and also making sure you understand how we work collaboratively on your wealth plan.

By walking you through an in-depth discovery and education process, we help you identify and address the concerns most important to you now and in the future.

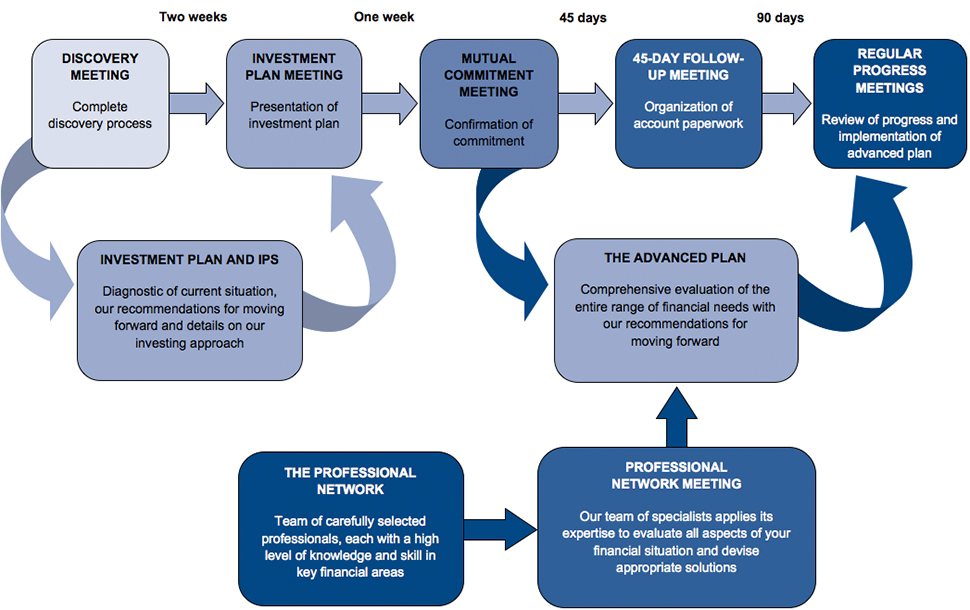

Our 5 Step Process includes:

1. The Discovery Meeting

At our initial meeting we focus on creating a Total Client Profile. This Profile goes well-beyond just determining your net worth, your time horizon and your risk tolerance. We delve deeper, exploring these seven key elements with you:

- Values – What is truly important to you about money and your finances? What does financial security and success mean to you?

- Goals – What are you trying to achieve and when?

- Relationships – Who are the important people in your life? How do you want to provide for them?

- Assets/Liabilities – What does your total financial picture look like?

- Advisors – Who are the people you rely on for advice? What has worked for you and what hasn’t in your dealings with your other advisors?

- Process – What method of communication do you prefer and how often do you want to hear from your advisors? What are your expectations of us?

- Interests – What are the things that make you most happy and are your passions? What do you like to do?

We want you to paint us a picture of where you see yourself now and where you want to be in the future.

2. The Investment Plan Meeting

In this meeting we will present you with a detailed actionable investment plan to serve as a roadmap for helping you achieve your financial goals. We will work to clarify and solidify your personal goals, analyze your current situation and make recommendations for moving forward.

3. The Mutual Commitment Meeting

Once we have agreed to work together, we finalize the necessary paperwork to put the investment plan in place. We will also begin discussing your financial needs beyond the investment plan and schedule additional meetings.

4. The Follow-Up Meeting

The focus of this meeting is to review any transactions, look at how the overall process has been working to date and answer any questions. We will go over the next steps and plan for regular future meetings.

5. Regular Progress Meetings

At these meetings, we will continue to review your investment plan as well as discuss and implement advanced planning strategies. We will also work with you to assess and manage relationships with your other advisors to create your personal wealth team.

We encourage you to contact us for more information.

Our Approach

(Click to enlarge)